5 Must-Dos for Managing Your Budget

5 Must-Dos for Managing Your Budget

5 Must-Dos for Managing Your Budget

5 Must-Dos for Managing Your Budget

February 28, 2022

February 28, 2022

February 28, 2022

February 28, 2022

Ad Disclosure

Ad Disclosure

Ad Disclosure

Ad Disclosure

People are often unsure of how to manage their finances, whether they’re trying to save for retirement or just make sure they can cover the bills each month. When your financial life feels like it's in survival mode, it’s hard to plan for the future - let alone enjoy it.

This is why managing your budget is so important. With a budget that factors in both immediate and long-term goals, you can better manage your money and stay on track for the future. Don't fall into those common budgeting mistake traps. Instead, manage your budget wisely.

Stats show that most Americans aren’t good at budgeting. According to a recent survey, only 41% of people have created a long-term financial plan, and only 27% stick to it consistently.

So what can you do to help manage your budget? Here are five ‘must-dos’ to get you started:

1. Make A Reasonable Budget

One of the main reasons that budgets are so challenging to stick to is that they’re often too restrictive. Similar to a New Year's resolution to lose weight too fast, an overly-ambitious budget can be hard to keep up with.

The best way to start is by making a realistic budget that allows you some wiggle room. Consider creating separate budgets for different areas of spending, such as groceries, entertainment, and travel. This will help you stay on track while allowing you to enjoy life at the same time.

If you create a budget so tight that you always feel like you’re missing out, it's likely to be hard to stick with

2. Track Down Those Pesky Automatic Charges

Some monthly charges can slip under the radar and add up quickly. Netflix, Amazon Prime, Spotify, and other subscription services can be great budget-savers. But if you’re not careful they can quietly eat away at your budget every month.

Be sure to keep an eye on all of your automatic payments and cut down or cancel any that you no longer use or need. If you have trouble finding payments hiding in your budget, use an app that can scan for payments and alert you when a charge appears - and even unsubscribe for you if you don’t want it.

3. Schedule Time to Review Your Budget Consistently

Making a budget is only a small part of the equation. You also need to set aside time to review it and make sure you’re on track with your financial goals.

Take some time each month to review your spending and come up with ways to adjust or cut back if needed. Whether you are tracking a personal budget or a family budget, be sure to check in regularly and review your progress. This accountability will help you stick to your budget and reach your goals.

4. Move Money Before You Can Spend It

If you’re finding it hard to keep your budget in check, consider setting up automatic transfers into an investment or high yield savings account. That way, the money is out of sight and out of mind — so you won't be tempted to spend it! If you want to set aside money and not access it, Certificates of Deposit's are great alternatives to high yield savings accounts.

It can also help move money into separate accounts designed for specific expenses. This is a great practice for a 70/20/10 budget!

For example, you might set up an account for groceries or entertainment. That way, the money is there when you need it and cannot be used on something else. If you don't have the money allocated in that specific account, you know you can't spend it.

5. Track It All With a Budget App

Finally, take advantage of budgeting apps and software to make the process easier. You can use them to track your spending, set reminders for bill payments, and keep an eye on your overall financial well-being.

Apps make it easy to automate your budget tracking system, chiming in with alerts and automated reminders to help you stay on track. And many offer helpful features such as goal-setting, budgeting templates, and financial advice that can make budgeting easier and more fun.

BONUS! 6. Celebrate Milestones

The reason that spending is so addictive comes down to brain chemistry. Dopamine is released when you spend money, creating an enjoyable feeling that keeps you coming back for more.

But the same can be done with budgeting and saving. Set achievable goals and reward yourself when you reach them — it will help keep you motivated to stay on track with your budget and financial goals. Whether it’s a dinner out or a weekend getaway, allow yourself to enjoy the good feeling of success — and use that boost to keep going!

Build & Keep Your Budget with Hiatus

By following these five steps, you’ll be well on your way to creating a budget that works for you — and better managing your finances.

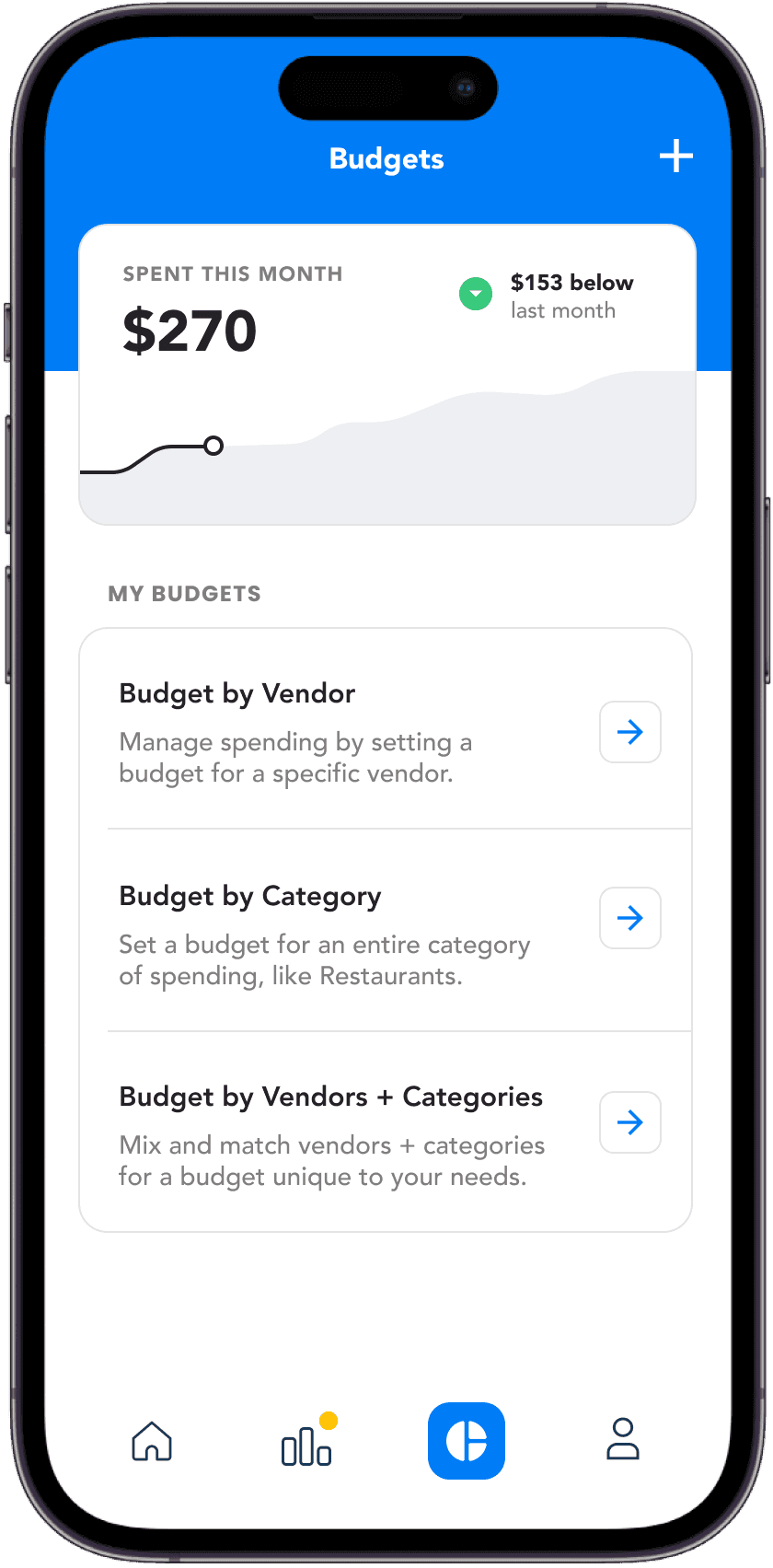

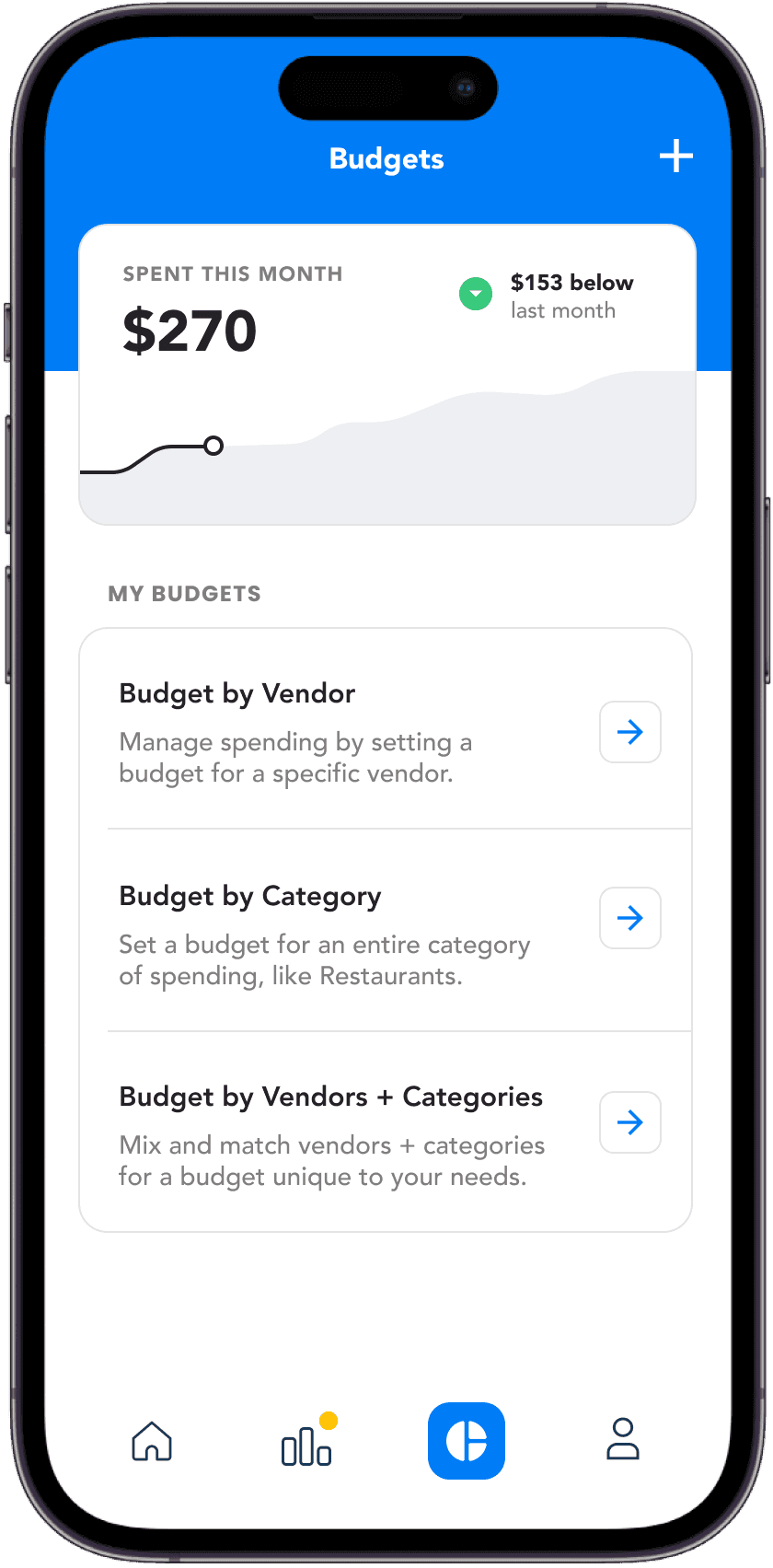

If you’re looking for a budgeting app that can help make managing your finances easier, the Hiatus app is just what you need.

Hiatus offers an intuitive budget tracking system and money management tools to help you build and stick to a budget that works for you. With Hiatus, you can track your spending in real time, analyze your financial data and get personalized advice to help you meet your financial goals. Plus, you can find those pesky hidden charges and cancel them with just a few clicks.

Try Hiatus today to get started on the path towards financial freedom!

People are often unsure of how to manage their finances, whether they’re trying to save for retirement or just make sure they can cover the bills each month. When your financial life feels like it's in survival mode, it’s hard to plan for the future - let alone enjoy it.

This is why managing your budget is so important. With a budget that factors in both immediate and long-term goals, you can better manage your money and stay on track for the future. Don't fall into those common budgeting mistake traps. Instead, manage your budget wisely.

Stats show that most Americans aren’t good at budgeting. According to a recent survey, only 41% of people have created a long-term financial plan, and only 27% stick to it consistently.

So what can you do to help manage your budget? Here are five ‘must-dos’ to get you started:

1. Make A Reasonable Budget

One of the main reasons that budgets are so challenging to stick to is that they’re often too restrictive. Similar to a New Year's resolution to lose weight too fast, an overly-ambitious budget can be hard to keep up with.

The best way to start is by making a realistic budget that allows you some wiggle room. Consider creating separate budgets for different areas of spending, such as groceries, entertainment, and travel. This will help you stay on track while allowing you to enjoy life at the same time.

If you create a budget so tight that you always feel like you’re missing out, it's likely to be hard to stick with

2. Track Down Those Pesky Automatic Charges

Some monthly charges can slip under the radar and add up quickly. Netflix, Amazon Prime, Spotify, and other subscription services can be great budget-savers. But if you’re not careful they can quietly eat away at your budget every month.

Be sure to keep an eye on all of your automatic payments and cut down or cancel any that you no longer use or need. If you have trouble finding payments hiding in your budget, use an app that can scan for payments and alert you when a charge appears - and even unsubscribe for you if you don’t want it.

3. Schedule Time to Review Your Budget Consistently

Making a budget is only a small part of the equation. You also need to set aside time to review it and make sure you’re on track with your financial goals.

Take some time each month to review your spending and come up with ways to adjust or cut back if needed. Whether you are tracking a personal budget or a family budget, be sure to check in regularly and review your progress. This accountability will help you stick to your budget and reach your goals.

4. Move Money Before You Can Spend It

If you’re finding it hard to keep your budget in check, consider setting up automatic transfers into an investment or high yield savings account. That way, the money is out of sight and out of mind — so you won't be tempted to spend it! If you want to set aside money and not access it, Certificates of Deposit's are great alternatives to high yield savings accounts.

It can also help move money into separate accounts designed for specific expenses. This is a great practice for a 70/20/10 budget!

For example, you might set up an account for groceries or entertainment. That way, the money is there when you need it and cannot be used on something else. If you don't have the money allocated in that specific account, you know you can't spend it.

5. Track It All With a Budget App

Finally, take advantage of budgeting apps and software to make the process easier. You can use them to track your spending, set reminders for bill payments, and keep an eye on your overall financial well-being.

Apps make it easy to automate your budget tracking system, chiming in with alerts and automated reminders to help you stay on track. And many offer helpful features such as goal-setting, budgeting templates, and financial advice that can make budgeting easier and more fun.

BONUS! 6. Celebrate Milestones

The reason that spending is so addictive comes down to brain chemistry. Dopamine is released when you spend money, creating an enjoyable feeling that keeps you coming back for more.

But the same can be done with budgeting and saving. Set achievable goals and reward yourself when you reach them — it will help keep you motivated to stay on track with your budget and financial goals. Whether it’s a dinner out or a weekend getaway, allow yourself to enjoy the good feeling of success — and use that boost to keep going!

Build & Keep Your Budget with Hiatus

By following these five steps, you’ll be well on your way to creating a budget that works for you — and better managing your finances.

If you’re looking for a budgeting app that can help make managing your finances easier, the Hiatus app is just what you need.

Hiatus offers an intuitive budget tracking system and money management tools to help you build and stick to a budget that works for you. With Hiatus, you can track your spending in real time, analyze your financial data and get personalized advice to help you meet your financial goals. Plus, you can find those pesky hidden charges and cancel them with just a few clicks.

Try Hiatus today to get started on the path towards financial freedom!

Find Ways to Save

Find Ways to Save

Find Ways to Save

Find Ways to Save