10 Tips to Save Money This Holiday Season

10 Tips to Save Money This Holiday Season

10 Tips to Save Money This Holiday Season

10 Tips to Save Money This Holiday Season

December 1, 2023

December 1, 2023

December 1, 2023

December 1, 2023

Ad Disclosure

Ad Disclosure

Ad Disclosure

Ad Disclosure

With inflation rising at faster rates, paychecks are stretched thinner than ever. The holidays are fast approaching, and saving money is on everyone's mind. So what can you do to help cut costs and have the holiday season you deserve?

If you are looking to get creative with your finances this holiday season, here are ten tips to save money this holiday season:

1. Get Creative With Your Gift-Giving!

Who said money buys happiness? Take your holiday gifting up a notch by being unique and personal with your presents.

Get crafty, make something yourself or put together a gift basket full of items your family will use and appreciate.

When you create your own gifts or put together a thoughtful basket, you'll save money and show your loved ones how much you care. Creative gifts can also come cheap if you plan ahead.

2. Open a Second Credit Card, But Use It Wisely

Credit cards can be useful around the holidays if you use them wisely. If not, you can end up in credit card debt from holiday shopping. No matter the type of card you decide to go with, whether it's a joint credit card or secured card, the holidays could be a great time to get another card.

Some of the best second credit cards will offer you intro bonuses for spending a certain amount when you open an account. Knowing that you’re going to spend the money, why not get rewarded for your holiday spending?

With inflation rising at faster rates, paychecks are stretched thinner than ever. The holidays are fast approaching, and saving money is on everyone's mind. So what can you do to help cut costs and have the holiday season you deserve?

If you are looking to get creative with your finances this holiday season, here are ten tips to save money this holiday season:

1. Get Creative With Your Gift-Giving!

Who said money buys happiness? Take your holiday gifting up a notch by being unique and personal with your presents.

Get crafty, make something yourself or put together a gift basket full of items your family will use and appreciate.

When you create your own gifts or put together a thoughtful basket, you'll save money and show your loved ones how much you care. Creative gifts can also come cheap if you plan ahead.

2. Open a Second Credit Card, But Use It Wisely

Credit cards can be useful around the holidays if you use them wisely. If not, you can end up in credit card debt from holiday shopping. No matter the type of card you decide to go with, whether it's a joint credit card or secured card, the holidays could be a great time to get another card.

Some of the best second credit cards will offer you intro bonuses for spending a certain amount when you open an account. Knowing that you’re going to spend the money, why not get rewarded for your holiday spending?

3. Shop Around For The Best Deals

With so many retailers competing for your business, there are bound to be some great deals out there. Make sure you take the time to look for them. Avoid the last-minute rush and shop early. Whether you're shopping online or in brick-and-mortar stores, be sure to compare prices and take advantage of sales and special offers.

You can also save money this holiday season by doing your holiday shopping throughout the year. If you find an unbeatable deal on something your loved one would like, don’t hesitate to buy it then. Chances are it'll be even more expensive closer to the holidays.

4. Set A Budget - And Stick To It

This one may seem obvious, but it's essential to set a realistic budget for your holiday spending - and then make sure you stick to it. Once you know how much you can afford to spend, start looking for gifts that fit within your budget. Keep in mind that you don't have to spend a lot of money to give a great gift.

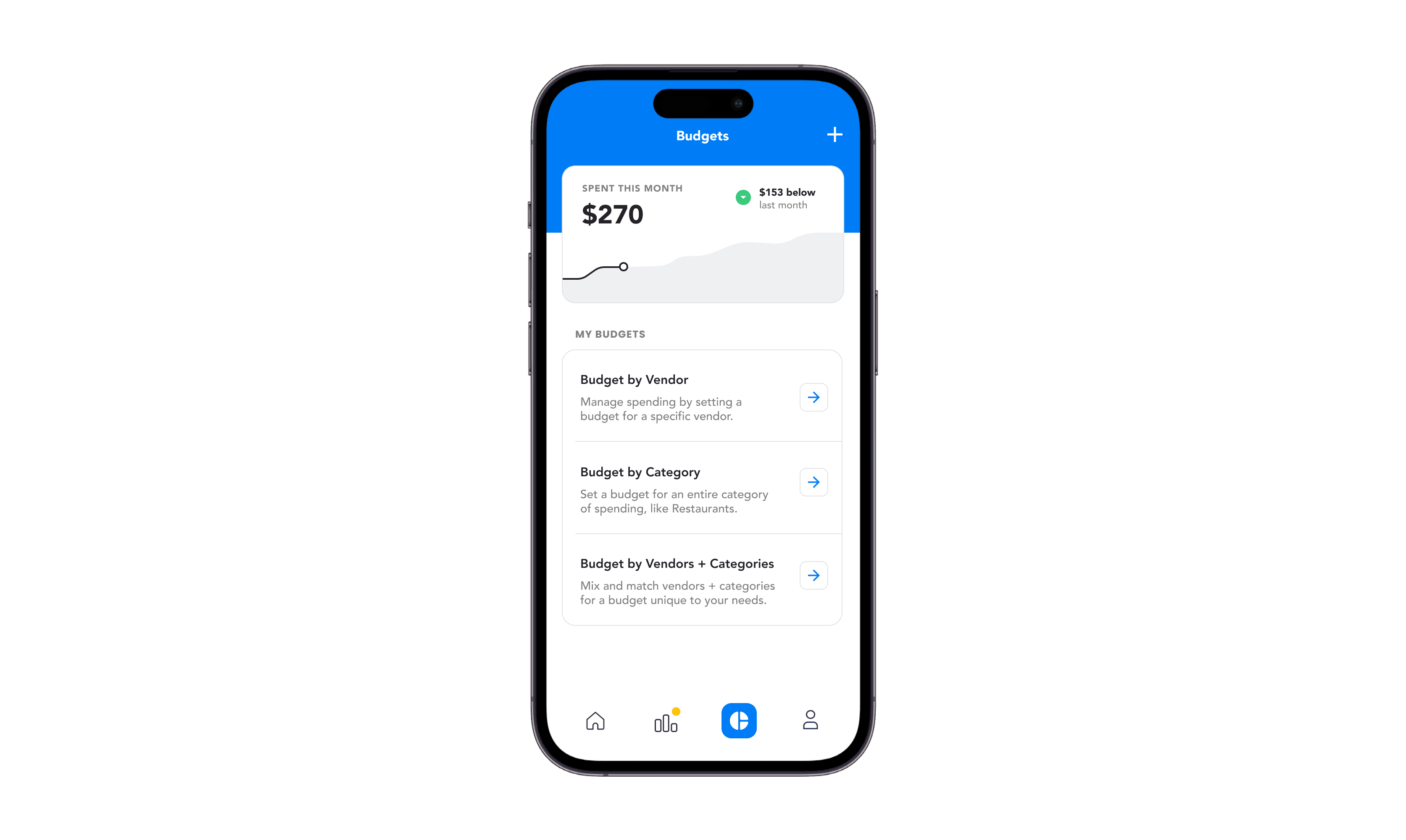

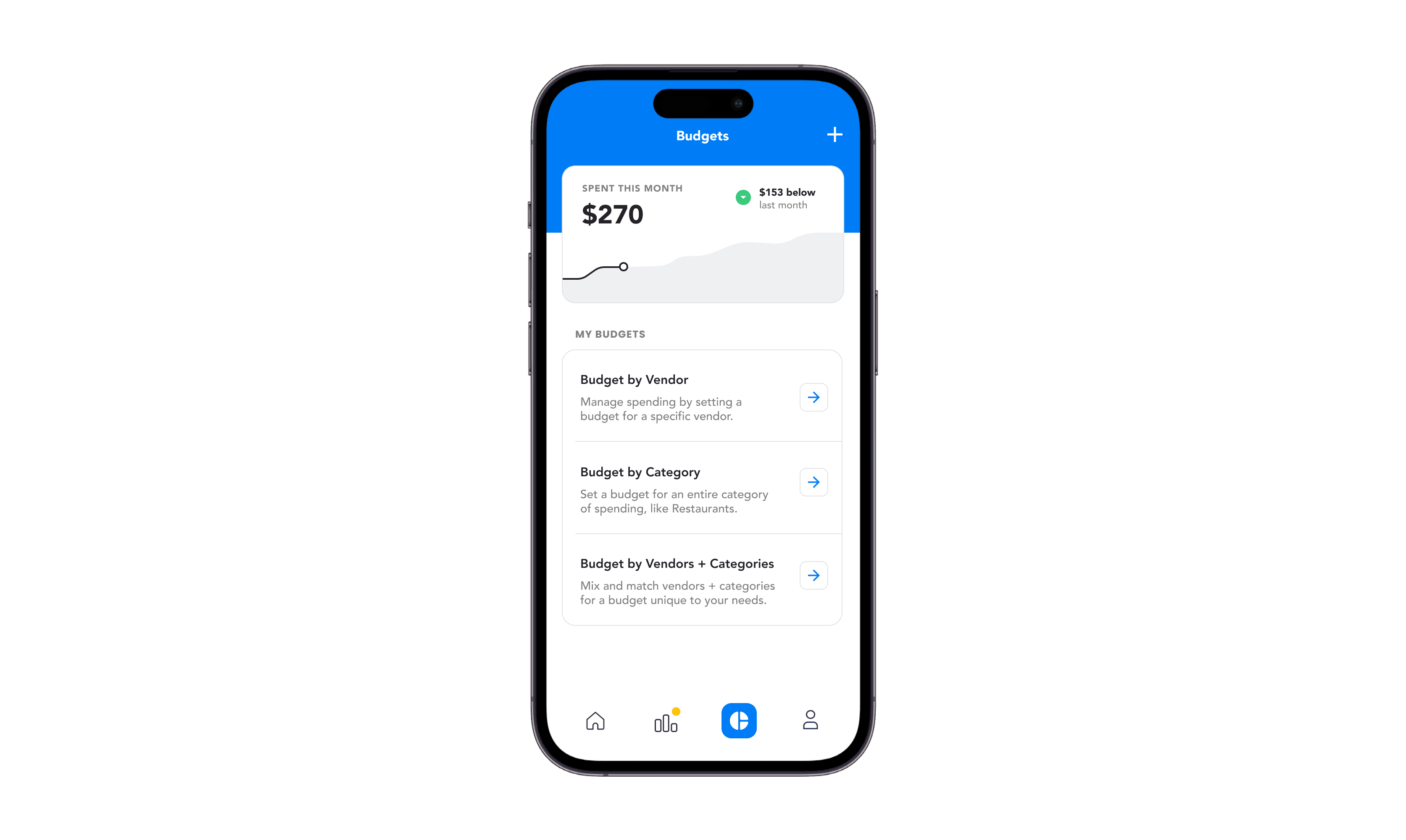

If you're struggling to stay within your budget, try using an app that helps you track and manage your finances. This can be a great way to help you stay mindful of your spending and avoid overspending during the holidays.

3. Shop Around For The Best Deals

With so many retailers competing for your business, there are bound to be some great deals out there. Make sure you take the time to look for them. Avoid the last-minute rush and shop early. Whether you're shopping online or in brick-and-mortar stores, be sure to compare prices and take advantage of sales and special offers.

You can also save money this holiday season by doing your holiday shopping throughout the year. If you find an unbeatable deal on something your loved one would like, don’t hesitate to buy it then. Chances are it'll be even more expensive closer to the holidays.

4. Set A Budget - And Stick To It

This one may seem obvious, but it's essential to set a realistic budget for your holiday spending - and then make sure you stick to it. Once you know how much you can afford to spend, start looking for gifts that fit within your budget. Keep in mind that you don't have to spend a lot of money to give a great gift.

If you're struggling to stay within your budget, try using an app that helps you track and manage your finances. This can be a great way to help you stay mindful of your spending and avoid overspending during the holidays.

5. Don't Forget About Freebies And Discounts

There are plenty of ways to get free or discounted items during the holidays - you just have to know where to look.

Many stores offer loyalty programs that give you access to exclusive deals and coupons. And don't forget about online discount codes - a quick search can often reveal coupons for everything from free shipping to a percentage off your purchase.

You can also take advantage of holiday promotions, such as Black Friday sales and Cyber Monday deals. Many retailers offer discounts on popular items, so it's worth checking out your favorite stores' websites and social media accounts to see what's being offered.

6.Go With Potluck Or Do A Secret Santa

Have a lot of siblings and relatives? Buying for every relative can put a dent in your wallet. A great solution to this is to take part in a Secret Santa or white elephant gift exchange. Instead of buying dozens of gifts, everybody picks a name out of a hat and only has to buy a gift for that person. Most times there’s a spending limit per gift as well.

Another way to save this holiday season is to minimize the amount of food you cook for the holidays. Instead of serving a large meal for 30-40 people, take part in pot luck where everybody brings a dish. This will allow you to try a wide variety of food as well.

7. Travel Smart

Gifts aren't the only reason that money is tight during the holidays - travel can also take a big bite out of your budget.

If you're planning on visiting family or friends, plan ahead and compare prices on flights and hotels. And if you're driving, be sure to map out your route in advance and take advantage of gas station rewards programs to save money on fuel. This is just one of the few ways you can save money while traveling.

8.Regifting

Maybe it’s not the most “thoughtful” gift to give, however it won’t cost you. Plus, the person who is receiving the gift may really enjoy it.

Gifts that you received which serve you no purpose, like that toaster you already have, could be a great gift to cousin Johnny who just bought a house. It might make you feel guilty, but these gifts can still add lots of value to your loved ones.

9. Skip The Holiday Parties

While it can be tempting to attend every holiday party, consider choosing which ones to be at. By no means are we saying to be The Grinch and not to go to any, but maybe it’s not necessary to go to the “friend of a friend’s” party. Not only will it save you money this holiday season, but it will also give you more time to spend with family and friends.

Plus, who doesn’t enjoy snuggling up in a cozy blanket with the fireplace on watching a Christmas movie?

10. Use An App To Track Your Finances and reach your goals

One of the best ways to stay on track financially and save money fast is to use a budgeting or financial tracking app. These apps can help you see where your money is going, set goals and track your progress over time.

When it comes to choosing the right app, make sure to look for features such as:

The ability to create a budget and track your spending

Financial goal setting and tracking with helpful insights

Easy-to-use interface and mobile accessibility

Easy unsubscription services for unwanted recurring charges

An app that tracks your finances can be a great way to help you stay on budget and reach your financial goals - all while making the most of your holiday spending.

Save More this Holiday Season with Hiatus

With careful planning and a little bit of creativity, you can give great gifts and still save money this holiday season. By following these tips, you can make sure your holidays are merry - and bright - without going into debt.

If you want to save even more this holiday season, check out Hiatus. Hiatus connects the dots between your financial goals and everyday spending, so you can save money without thinking about it. Plus, intuitive technology tracks and targets unwanted subscriptions, so you can save money on recurring charges.

Hiatus helps you go beyond canceling subscriptions to meeting your financial goals. By targeting specific goals (such as saving for a rainy day fund or paying off debt), you can ensure that your money always works for you - especially during the expensive holiday season.

Ready to start saving this holiday season - and beyond? Check out Hiatus today, and discover how easy it is to stop unwanted or forgotten subscriptions from draining your holiday budget!

5. Don't Forget About Freebies And Discounts

There are plenty of ways to get free or discounted items during the holidays - you just have to know where to look.

Many stores offer loyalty programs that give you access to exclusive deals and coupons. And don't forget about online discount codes - a quick search can often reveal coupons for everything from free shipping to a percentage off your purchase.

You can also take advantage of holiday promotions, such as Black Friday sales and Cyber Monday deals. Many retailers offer discounts on popular items, so it's worth checking out your favorite stores' websites and social media accounts to see what's being offered.

6.Go With Potluck Or Do A Secret Santa

Have a lot of siblings and relatives? Buying for every relative can put a dent in your wallet. A great solution to this is to take part in a Secret Santa or white elephant gift exchange. Instead of buying dozens of gifts, everybody picks a name out of a hat and only has to buy a gift for that person. Most times there’s a spending limit per gift as well.

Another way to save this holiday season is to minimize the amount of food you cook for the holidays. Instead of serving a large meal for 30-40 people, take part in pot luck where everybody brings a dish. This will allow you to try a wide variety of food as well.

7. Travel Smart

Gifts aren't the only reason that money is tight during the holidays - travel can also take a big bite out of your budget.

If you're planning on visiting family or friends, plan ahead and compare prices on flights and hotels. And if you're driving, be sure to map out your route in advance and take advantage of gas station rewards programs to save money on fuel. This is just one of the few ways you can save money while traveling.

8.Regifting

Maybe it’s not the most “thoughtful” gift to give, however it won’t cost you. Plus, the person who is receiving the gift may really enjoy it.

Gifts that you received which serve you no purpose, like that toaster you already have, could be a great gift to cousin Johnny who just bought a house. It might make you feel guilty, but these gifts can still add lots of value to your loved ones.

9. Skip The Holiday Parties

While it can be tempting to attend every holiday party, consider choosing which ones to be at. By no means are we saying to be The Grinch and not to go to any, but maybe it’s not necessary to go to the “friend of a friend’s” party. Not only will it save you money this holiday season, but it will also give you more time to spend with family and friends.

Plus, who doesn’t enjoy snuggling up in a cozy blanket with the fireplace on watching a Christmas movie?

10. Use An App To Track Your Finances and reach your goals

One of the best ways to stay on track financially and save money fast is to use a budgeting or financial tracking app. These apps can help you see where your money is going, set goals and track your progress over time.

When it comes to choosing the right app, make sure to look for features such as:

The ability to create a budget and track your spending

Financial goal setting and tracking with helpful insights

Easy-to-use interface and mobile accessibility

Easy unsubscription services for unwanted recurring charges

An app that tracks your finances can be a great way to help you stay on budget and reach your financial goals - all while making the most of your holiday spending.

Save More this Holiday Season with Hiatus

With careful planning and a little bit of creativity, you can give great gifts and still save money this holiday season. By following these tips, you can make sure your holidays are merry - and bright - without going into debt.

If you want to save even more this holiday season, check out Hiatus. Hiatus connects the dots between your financial goals and everyday spending, so you can save money without thinking about it. Plus, intuitive technology tracks and targets unwanted subscriptions, so you can save money on recurring charges.

Hiatus helps you go beyond canceling subscriptions to meeting your financial goals. By targeting specific goals (such as saving for a rainy day fund or paying off debt), you can ensure that your money always works for you - especially during the expensive holiday season.

Ready to start saving this holiday season - and beyond? Check out Hiatus today, and discover how easy it is to stop unwanted or forgotten subscriptions from draining your holiday budget!

Find Ways to Save

Find Ways to Save

Find Ways to Save

Find Ways to Save