9 Steps To Improve Your Finances This Year

9 Steps To Improve Your Finances This Year

9 Steps To Improve Your Finances This Year

9 Steps To Improve Your Finances This Year

April 20, 2023

April 20, 2023

April 20, 2023

April 20, 2023

Ad Disclosure

Ad Disclosure

Ad Disclosure

Ad Disclosure

If you’re like most people, improving your finances may be on the top of your to-do list this year. Whether it’s looking for quick ways to get money fast, pay off debt, or invest for the future, managing your finances can be a dreadful task.

But with the right strategies and a bit of discipline, you can achieve your money goals and take control of your finances. Here are nine steps to help you improve your finances this year.

1. Set Clear Goals

The first step to boosting your finances is to set clear financial goals for yourself. A great way to start is by asking yourself what it is that you’re looking to achieve this year. These could range from short-term goals like saving up for a vacation or car repair, to long-term goals such as investing in retirement savings or paying off debt. Having well-defined goals will give you something to work towards throughout the year and can help keep you motivated.

If you’re like most people, improving your finances may be on the top of your to-do list this year. Whether it’s looking for quick ways to get money fast, pay off debt, or invest for the future, managing your finances can be a dreadful task.

But with the right strategies and a bit of discipline, you can achieve your money goals and take control of your finances. Here are nine steps to help you improve your finances this year.

1. Set Clear Goals

The first step to boosting your finances is to set clear financial goals for yourself. A great way to start is by asking yourself what it is that you’re looking to achieve this year. These could range from short-term goals like saving up for a vacation or car repair, to long-term goals such as investing in retirement savings or paying off debt. Having well-defined goals will give you something to work towards throughout the year and can help keep you motivated.

2. Create a Budget

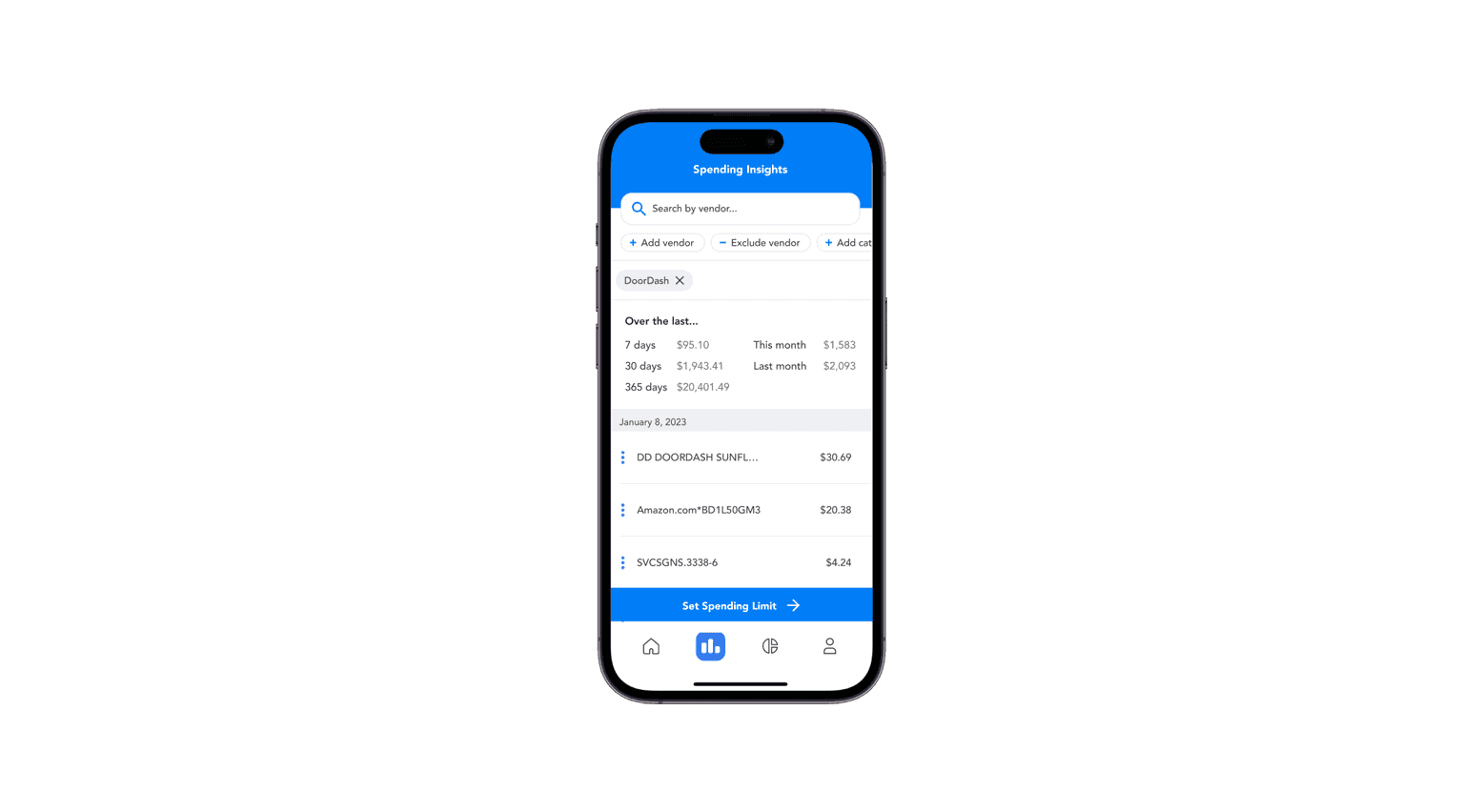

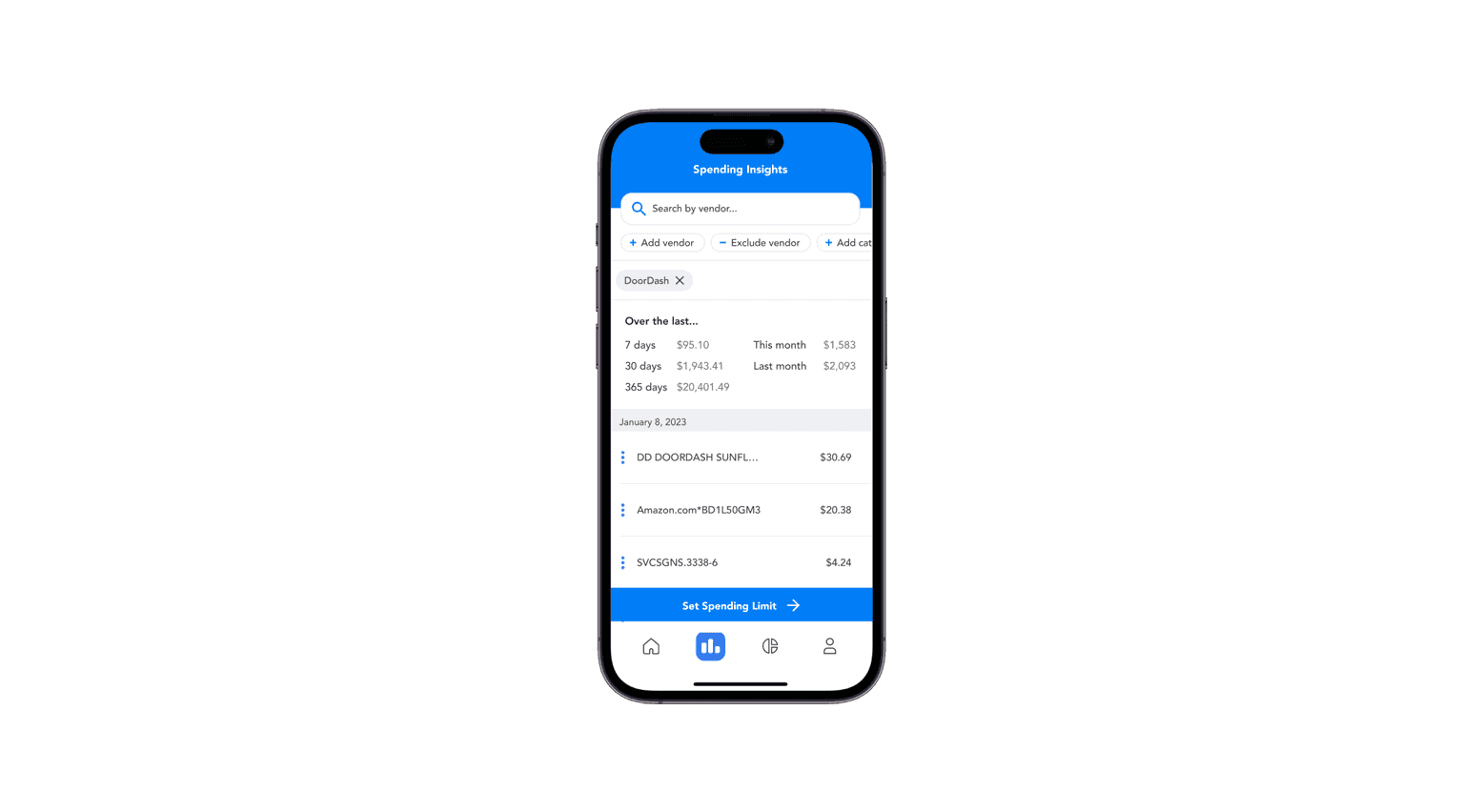

Once you know what you’re looking to accomplish, you should create a personal budget that reflects your financial goals. Knowing how much money you have coming in and going out each month will allow you to prioritize spending and set realistic financial goals. Using an app like Hiatus will allow you to create and manage your monthly budgets based on spending and ensure that you are living within your means.

3. Track Monthly Expenses

Seeing where your money is going and figuring out how you might be able to allocate it better is key to improving your finances. Some people prefer writing down their expenses on a piece of paper the old fashioned way or by using a spreadsheet. But with apps like Hiatus, you can automatically track your finances and see exactly how much and where you’re spending your money. Using an app will give access at all times to view these expenses instead of having to carry around a piece of paper.

2. Create a Budget

Once you know what you’re looking to accomplish, you should create a personal budget that reflects your financial goals. Knowing how much money you have coming in and going out each month will allow you to prioritize spending and set realistic financial goals. Using an app like Hiatus will allow you to create and manage your monthly budgets based on spending and ensure that you are living within your means.

3. Track Monthly Expenses

Seeing where your money is going and figuring out how you might be able to allocate it better is key to improving your finances. Some people prefer writing down their expenses on a piece of paper the old fashioned way or by using a spreadsheet. But with apps like Hiatus, you can automatically track your finances and see exactly how much and where you’re spending your money. Using an app will give access at all times to view these expenses instead of having to carry around a piece of paper.

4. Reduce Your Expenses

This goes hand in hand with tracking your expenses. Being able to identify areas where you can cut back on your spending is equally as important to achieve your goals faster. Evaluate which of your expenses are necessary, such as rent or groceries, and which ones can be reduced or eliminated altogether. Things such as eating out or canceling subscriptions that aren't being used often enough are a great way. The Hiatus app allows you to see all your subscriptions in one place and even lets you cancel them in just a few taps.

5. Invest In Your Future

Another way to work towards reaching your financial objectives is by saving money and investing in your future. Whether you start a side hustle, put some of your monthly income in a high yield savings account, or invest in services such as stocks, 401(k)s or retirement accounts, being able to automate your savings will come in handy down the line.

Decide what percentage of each paycheck you want to put aside so that it becomes second nature over time and requires less effort on your part. This takes out the stress of manually transferring money into different accounts each month.

6. Pay Off Your Debt

Debt can be a significant financial burden, and paying it off is crucial to achieving financial stability. Start by listing all your debts and creating a plan for paying them off. There are two approaches people tend to take when paying off their debt.

The first is by paying off the debt with the highest interest rate first, and then work your way down the list once that gets paid off. Or, you can pay off your debts with the smallest balance first and then proceed by paying off the next smallest one afterwards. Whichever method you decide works best for you, it’s important to stick to your budget so you avoid taking on new debt while paying off existing ones.

7. Stay Informed With Current Events

Part of managing one's finances involves staying informed about relevant news topics. Changes in tax laws or new investment opportunities may affect your portfolio positively or negatively, so being quick to take action can put you ahead of the game. This allows you to either reap the benefits from positive changes or limit the damages if it’s not so good news.

Different platforms that help you stay on top of current events and trends include listening to finance podcasts regularly or following finance related blogs and social media accounts. These updates should help give you an edge when it comes to making investment decisions.

8. Know Your Risk Tolerance Level

Taking risks with one's hard-earned money is a crucial factor for any investor, but it’s not just about sticking to the secure route. Knowing your own individual risk tolerance level allows you to confidently explore investment opportunities without taking on more than what makes sense and being too risky. Being aware of how far out of your comfort zone can enable you to make bolder decisions when confident, or help you recognize when you should take a step back before entering dangerous territory.

9. Monitor Credit Score

Staying on top of your credit score is essential for achieving financial success. It offers a valuable insight into any missteps from the past, and allows you to take proactive action in order build trustworthiness with creditors and banks alike. In other words, regularly monitoring your credit can open countless doors - maybe even that dream loan at an unbelievably low interest rate! So don't wait- taking steps towards improving your financially secure future today will make all the difference tomorrow.

Become a Better You Today

Improving your finances can be a challenging task but it’s one that’s well worth the effort. Just like all things, practice makes perfect. Following these nine steps will allow you to take control of your finances and achieve your money goals. So start today and take the first step towards financial freedom!

4. Reduce Your Expenses

This goes hand in hand with tracking your expenses. Being able to identify areas where you can cut back on your spending is equally as important to achieve your goals faster. Evaluate which of your expenses are necessary, such as rent or groceries, and which ones can be reduced or eliminated altogether. Things such as eating out or canceling subscriptions that aren't being used often enough are a great way. The Hiatus app allows you to see all your subscriptions in one place and even lets you cancel them in just a few taps.

5. Invest In Your Future

Another way to work towards reaching your financial objectives is by saving money and investing in your future. Whether you start a side hustle, put some of your monthly income in a high yield savings account, or invest in services such as stocks, 401(k)s or retirement accounts, being able to automate your savings will come in handy down the line.

Decide what percentage of each paycheck you want to put aside so that it becomes second nature over time and requires less effort on your part. This takes out the stress of manually transferring money into different accounts each month.

6. Pay Off Your Debt

Debt can be a significant financial burden, and paying it off is crucial to achieving financial stability. Start by listing all your debts and creating a plan for paying them off. There are two approaches people tend to take when paying off their debt.

The first is by paying off the debt with the highest interest rate first, and then work your way down the list once that gets paid off. Or, you can pay off your debts with the smallest balance first and then proceed by paying off the next smallest one afterwards. Whichever method you decide works best for you, it’s important to stick to your budget so you avoid taking on new debt while paying off existing ones.

7. Stay Informed With Current Events

Part of managing one's finances involves staying informed about relevant news topics. Changes in tax laws or new investment opportunities may affect your portfolio positively or negatively, so being quick to take action can put you ahead of the game. This allows you to either reap the benefits from positive changes or limit the damages if it’s not so good news.

Different platforms that help you stay on top of current events and trends include listening to finance podcasts regularly or following finance related blogs and social media accounts. These updates should help give you an edge when it comes to making investment decisions.

8. Know Your Risk Tolerance Level

Taking risks with one's hard-earned money is a crucial factor for any investor, but it’s not just about sticking to the secure route. Knowing your own individual risk tolerance level allows you to confidently explore investment opportunities without taking on more than what makes sense and being too risky. Being aware of how far out of your comfort zone can enable you to make bolder decisions when confident, or help you recognize when you should take a step back before entering dangerous territory.

9. Monitor Credit Score

Staying on top of your credit score is essential for achieving financial success. It offers a valuable insight into any missteps from the past, and allows you to take proactive action in order build trustworthiness with creditors and banks alike. In other words, regularly monitoring your credit can open countless doors - maybe even that dream loan at an unbelievably low interest rate! So don't wait- taking steps towards improving your financially secure future today will make all the difference tomorrow.

Become a Better You Today

Improving your finances can be a challenging task but it’s one that’s well worth the effort. Just like all things, practice makes perfect. Following these nine steps will allow you to take control of your finances and achieve your money goals. So start today and take the first step towards financial freedom!

Find Ways to Save

Find Ways to Save

Find Ways to Save

Find Ways to Save